- December 11th will be your chance to hear the details of the tentative Central Teacher / Occasional Teacher Collective Agreement as Provincial ETFO will be holding evening telephone Town Halls. For more details go to https://etfocb.ca/teacher-occasional-teacher-tentative-central-agreement/teacher-occasional-teacher-tentative-central-agreement-frequently-asked-questions/

- Provincial ETFO is conducting a study on the needs and challenges experienced in their first five years. The Local encourages new members who receive the invitation from ETFO to participate in the Survey Monkey so that the provincial office can better support you in your new career. The survey closes at 9 AM on Monday, December 18th.

- Should an Administrator ask you to use your prep period to cover a class etc., the Local encourages members to keep track of the date, the school, the time of the scheduled prep period and the number of minutes that were lost. In previous years, the Local has negotiated payment for such lost time so we ask that members please advise the Local at etfotvot@gmail.com so we can track if the problem is systemic again this school year. Remember - a right gained, is never a right secured. We must all remain vigilant.

- If you are in a LTO assignment with an undetermined end, then you need to wait 90 calendar days in order to become eligible for benefits. For more information go to https://etfo-elhtbenefits.ca/faqs/

- Article L35.00(iii) states: When a long-term occasional teaching assignment is

completed prior to the required date for report cards to be submitted, the

Occasional Teacher may be assigned to assist with the completion of these

report cards. In such an event, the Occasional Teacher shall be paid for the

time to complete the report cards up to a maximum of one (1) day. The rate of

pay shall be the rate the Occasional Teacher received during the long-term

occasional teaching assignment.

_____________________

The top 8 things that

should be on your ‘end of the year financial to-do’ list

If you hold any kind of investments,

have children or grandchildren, or turned 71 this year, this is one list you

might want to bookmark. While it may not be filled with elaborate gifts or

delectable treats, taking care of the items on this

list will provide you with the financial peace of mind to make you merry not

only during the upcoming holiday season—but also in the years to come.

Here are your top 8 financial ‘to-dos’

before the end of the year:

#1: Consider making TFSA withdrawals by

December 31st.

If you were thinking about withdrawing

from your Tax-Free Savings Account in the next few months to pay for home

renovations, car repairs, or other big-ticket items—you might want to consider

taking that money out by December 31st. Otherwise, if you withdraw funds from

your TFSA after January 1st, you wouldn’t be able to re-contribute that money

until the following calendar year.

#2: Get those RESP contributions in by

December 31st to maximize the CESG.

While you can contribute to a Registered

Education Savings Plan anytime (within 31 years of opening it),

maximizing your contributions before the end of each calendar year has one very

specific benefit—getting the most from the Canada Education Savings Grant (CESG).

That’s where the government chips in up to 20% over and above your annual

contributions.

Read the full article: https://bit.ly/3QSUZsF

Brought to you by Educators Financial

Group. Helping the education community, and their

families, achieve their financial goals since 1975. Book your complimentary

consultation today: https://bit.ly/3sWAWRW.

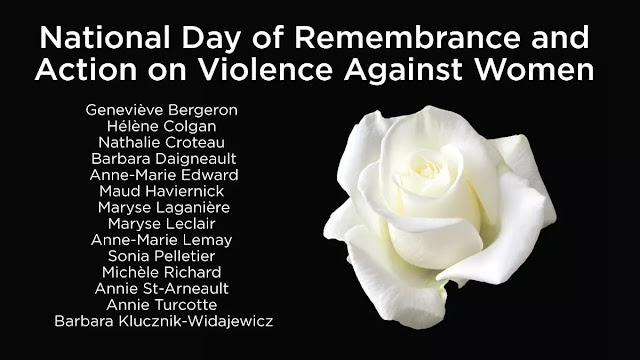

On December 6th, we remember -

.jpg)